Because NEDA said We can LIVE with 10K a month... Hypothetically. | Sunlife Perfect Match

Do you believe that you can do the hypothetical budget of 10k a month that NEDA suggested? It is quite impossible right? But really, in our everyday life ,while we need to make ends meet we also have to make sure that we leave a little something for our future- be it for our kids' education or retirement.

So how do we do that? We look, research and do sidelines, but it would also make things easier if we can easily find a teacher, or in life's case, a financial adviser that we can trust to guide us.

But it can be quite difficult because most of the time when we ask around, (or in my experience) I usually experience those who almost push their product on you, and it kinda shows that they don't really want to help you out- they just need to get their monthly quota much like in a real estate selling business or something. Nakakaturn off. But this is exactly what Sunlife Financial wants to change.

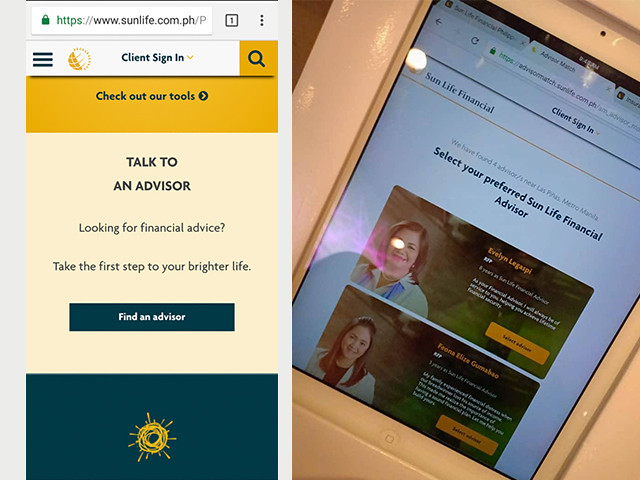

Sunlife Financial sets the mark just in time for the Financial Independence month of June 2018. The country’s first and #1 life insurer aims to educate Filipinos on choosing the right Financial Advisor to help them with your financial goals. And with that, they launched the Advisor Match tool, your perfect Sun Life advisor may just be a click away.

Said Advisor Match tool by Sunlife is available in their website, and yes, you can get one even if you are just browsing and looking for someone to guide you in this journey to financial independence- even if you don't have a Sunlife Account yet.

How does it work?

Well, it is fun and easy- with just a couple of clicks! All you have to do is:

Albeit we at the launch had a bit of a dating game spinoff to find our perfect (financial) match, Sunlife actually made it uncomplicated for your convenience. Such freedom to choose a Financial Advisor is both innovative and relevant, especially for consumers who want personalized service on-demand and at their convenience.

#

About Sun Life Financial

Sun Life Financial Inc. is a leading international financial services organization providing insurance, wealth and asset management solutions to individual and corporate Clients. Sun Life Financial has operations in a number of markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and Bermuda. As of March 31, 2018, Sun Life Financial had total assets under management of $979 billion. For more information, please visit www.sunlife.com. Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF.

So how do we do that? We look, research and do sidelines, but it would also make things easier if we can easily find a teacher, or in life's case, a financial adviser that we can trust to guide us.

But it can be quite difficult because most of the time when we ask around, (or in my experience) I usually experience those who almost push their product on you, and it kinda shows that they don't really want to help you out- they just need to get their monthly quota much like in a real estate selling business or something. Nakakaturn off. But this is exactly what Sunlife Financial wants to change.

Sun Life emphasizes four core values that every financial advisor should possess:

Professional in doing business

One who cares for your welfare

A desire to win for your dreams

an inspiring commitment to serve rather than sell.

Sunlife Financial sets the mark just in time for the Financial Independence month of June 2018. The country’s first and #1 life insurer aims to educate Filipinos on choosing the right Financial Advisor to help them with your financial goals. And with that, they launched the Advisor Match tool, your perfect Sun Life advisor may just be a click away.

Said Advisor Match tool by Sunlife is available in their website, and yes, you can get one even if you are just browsing and looking for someone to guide you in this journey to financial independence- even if you don't have a Sunlife Account yet.

How does it work?

Well, it is fun and easy- with just a couple of clicks! All you have to do is:

- to go to their website to access the Advisor Match.

- Enter your location to generate a list of advisors in your vicinity.

- Each profile contains a short description of their credentials and how they can extend help – a very nifty way to show you what they have to offer.

Albeit we at the launch had a bit of a dating game spinoff to find our perfect (financial) match, Sunlife actually made it uncomplicated for your convenience. Such freedom to choose a Financial Advisor is both innovative and relevant, especially for consumers who want personalized service on-demand and at their convenience.

With Sun Life’s SOLAR (Study of Lifestyle and Relationships), it reveals that only 38% of Filipinos are willing to take investment risks in order to earn more and that only 8% actually invest. Furthermore, only 16% claim to have life insurance despite 88% of Filipinos worrying about their financial situation in case something happens to the breadwinner.

Clearly, many Filipinos still need guidance and advice on how to achieve lifetime financial security. A role that a Sun Life Financial Advisor can fulfill with their professionalism, a caring attitude, a winning mindset, and an inspired vision.

The Advisor Match is more than just another tab on their website- we all have to take advantage of the fact that we can finally have a choice with getting our guide to financial success, one wherein WE DON'T STOP WHEN WE GET A BAD REFERRAL.

The Advisor Match is about empowering Filipinos to be more exacting and selective when looking for a financial partner. A series of online videos called “My Dream Advisor” puts a humorous twist on the challenging journey that comes with seeking one’s perfect advisor match. Taking a cue from the 90s dating game shows, the videos feature searchers faced with a rather disappointing line-up of advisor searchees – each embodying undesirable characteristics that have unfairly stereotyped life insurance agents for the longest time.

For its part, “We’ve seen a growing interest in personal finance lately with the number of inquiries and requests for advisor referrals doubling the past couple of years. We are happy to share that we are now empowering Filipinos to choose their very own Sun Life Advisor with just the click of a button. With Sun Life’s Advisor Match, they can be assured of finding competent and committed financial advisors to help them achieve their financial goals,” affirmed Sun Life Philippines Chief Marketing Officer Ms. Mylene Lopa. After all, finding your #SunLifePerfectMatch should never be difficult.

Go to advisormatch.sunlife.com.ph to experience the Advisor Match tool and learn more about finding the right partner in your financial journey.

#

About Sun Life Financial

Sun Life Financial Inc. is a leading international financial services organization providing insurance, wealth and asset management solutions to individual and corporate Clients. Sun Life Financial has operations in a number of markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and Bermuda. As of March 31, 2018, Sun Life Financial had total assets under management of $979 billion. For more information, please visit www.sunlife.com. Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF.

.jpg)

No comments